The Pennsylvania Counties Workers' Compensation Trust

(PComp) PComp provides workers' compensation coverage for employees of counties and county related entities which includes risk control, claims services and training.

Program Links

Questions?

Questions concerning our PComp Program, including requests for an application, should be directed to:

Membership Listing

Creation of PComp

History of PComp

PComp is a workers' compensation program developed by the County Commissioners Association of Pennsylvania (CCAP), in conjunction with PCoRP, the Pennsylvania Counties Risk Pool. Faced with rising costs and few commercial alternatives, counties requested that CCAP form a group workers' compensation program for counties. PComp started operations on January 1, 1993. PComp has been approved by the Pennsylvania Department of Labor and Industry to operate as a self insured workers' compensation pool under Act 44 of 1993.

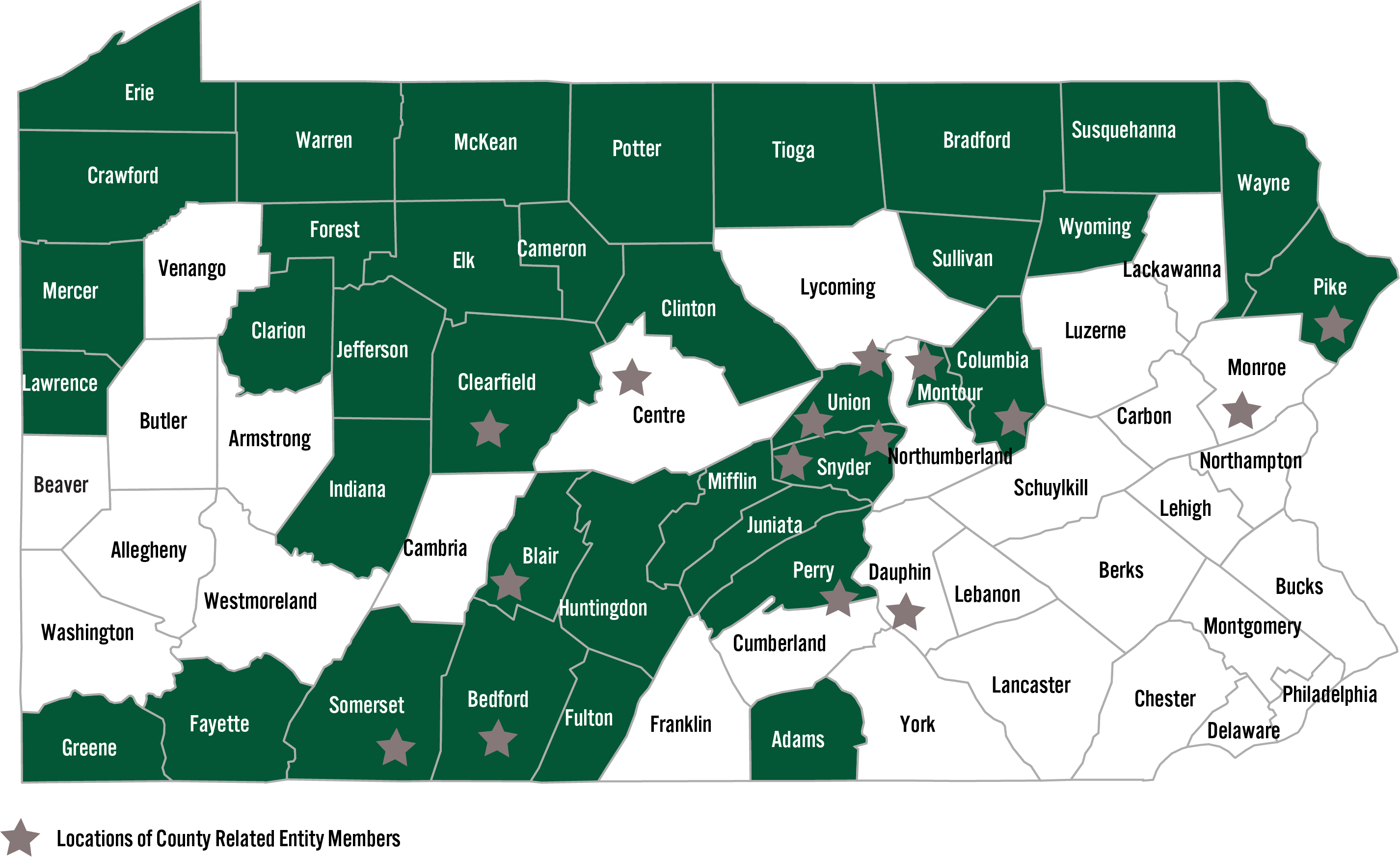

PComp can provide workers' compensation coverage for counties, and for county-related entities such as nursing homes and county joinders. County-related entities, for the purposes of membership in PComp, are organizations created and controlled by one or more counties to perform typical county functions.

PComp Structure

PComp is a Trust created by Pennsylvania counties pursuant to Act 44 of 1993. PComp's structure is similar to that of PCoRP, CCAP's very successful property/casualty coverage program. PComp is governed by a fifteen-member Board of Directors, with five members appointed by the President of CCAP, eight members elected by the Member Representatives and two County Related Entity Participants elected by the Board. Each participating county selects a representative to the PComp Board of Delegates. No county can have more than one representative on the Board of Directors.

PComp's Legal Counsel is Barbara Zemlock.

Program Goals

The goals of PComp are:

PComp Advantages

- Risk Management services designed for counties

- A rating system based solely on county loss data

- Full statutory Pennsylvania Workers' Compensation coverage

- Personalized claims service

- Governance controlled by participating counties

- Potential for future credits on contributions

- Designed to be a long term program

- Loss Fund contributions stay with PComp and generate interest earnings

PComp Finances

PComp pays all bona fide workers' compensation claims of employees of members. There is no deductible. The PComp loss fund pays claims up to $600,000 and amounts higher than this are paid by the reinsurer, an A.M. Best "A" rated carrier.

Members pay an annual contribution to PComp which is used to:

- Purchase specific excess coverage for the program

- Fund the PComp loss fund and pay claims

- Provide for operating expenses of the program

- Pay the PComp service firms

Cost Savings

By using only county data to establish rates, by retaining and earning interest on the PComp loss fund, and by enforcing an effective loss control program, PComp is designed to provide long term cost savings. Initially in 1983, PComp's rates were 5% lower than rates used by commercial insurance carriers, and the spread continued to broaden for several years.

With the workers' compensation insurance market tightening further, employers saw larger double-digit increases and tougher underwriting standards across the country. PComp rates continued to decline until 2001, when members saw the first rate increase of approximately 10% Losses continue to increase, especially with acceleration in medical costs, raising the rate of inflation on workers' compensation claims costs.

PComp remains financially secure and very price competitive with loss control and claim services second to none.