PELICAN Insurance is a Risk Retentions Group (RRG) based out of Vermont and is a sponsored program of PACAH (Pennsylvania Coalition of Affiliated Healthcare & Living Communities). A Reciprocal Risk Retention Group, which provides Professional Liability and General Liability Insurance coverage.

Questions?

Questions concerning our PELICAN Insurance program, including requests for an application, should be directed to:

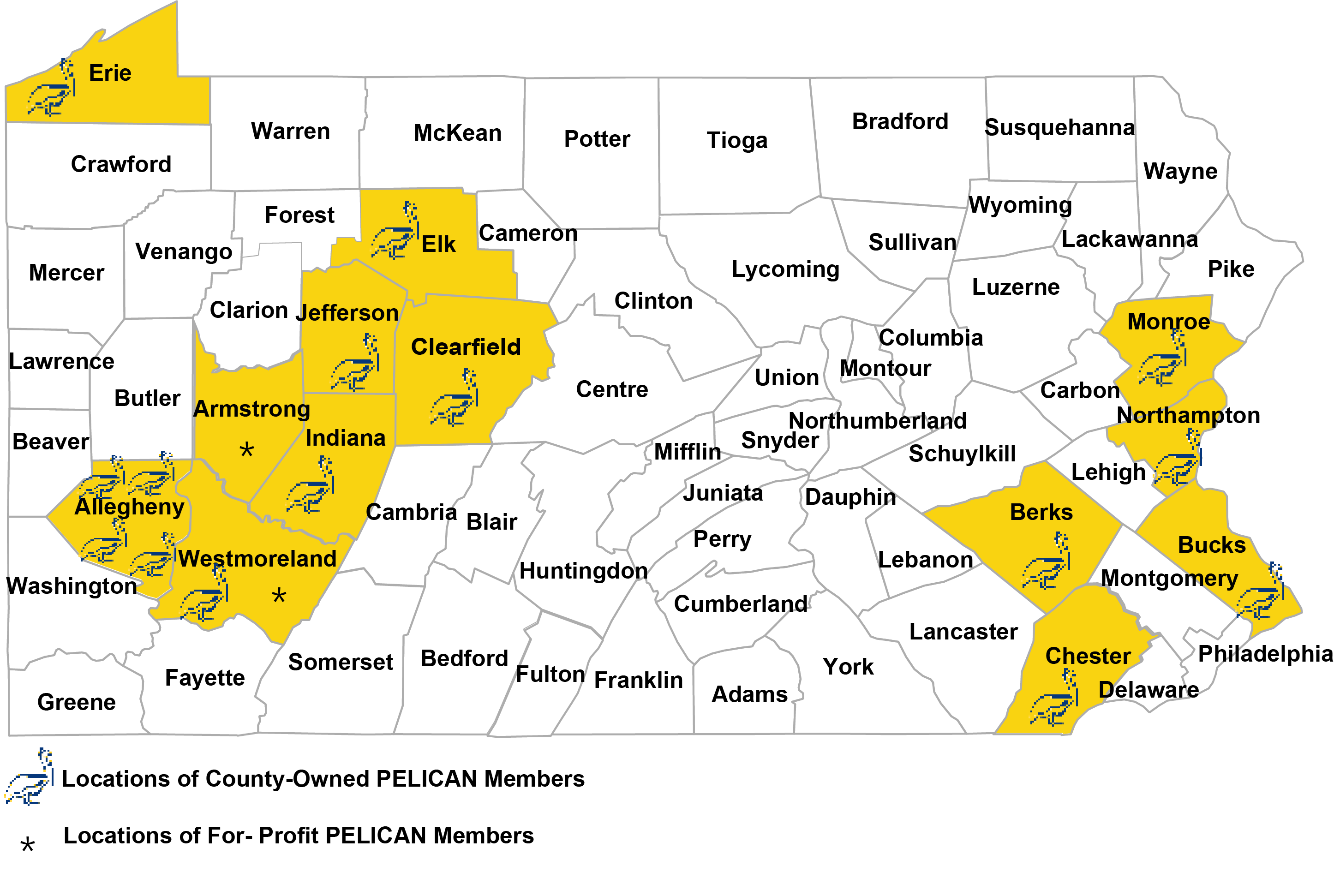

Membership Listing

- Berks County Home - Berks Heim

- Communities at Indian Haven

- DuBois Nursing Home

- Elk Haven Nursing Home

- Gracedale Nursing Home

- Kane Community Living Centers – Glen Hazel

- Kane Community Living Centers – McKeesport

- Kane Community Living Centers – Ross

- Kane Community Living Centers – Scott

- Loyalhanna Health Care Associates

- Neshaminy Manor Nursing Home

- Pleasant Ridge Manor Nursing Home

- Pleasant Valley Manor

- Pocopson Home

- Ridge at Heritage Meadows

- Westmoreland Manor

Application Process

The process for joining PELICAN is as follows:

- The nursing home will be required to complete an application for insurance, and to forward the completed application to CCAP via their local producer. PELICAN can not work directly with the nursing home.

- PELICAN's underwriters will review the application to evaluate the degree of risk associated with it and, for applications meeting PELICAN's underwriting standards, will prepare and forward to the applicant a premium quotation indicating coverage terms and conditions.

- Subject to payment of the premium, and submission of a signed Subscribers' Agreement, along with any other required supporting documents, a policy will be issued to the nursing home. PELICAN Insurance Program has a common effective date of 3/1. A nursing home may enter the program at any time during the policy period. If the nursing home enters the program mid-term, the premium will be pro-rated.

- PELICAN's premium is due in one payment (installment payments can be accommodated with prior approval).

To request an application please email insurance@pacounties.org.

Eligibility

- PELICAN is open, but not restricted to, all PACAH members.

- Assisted Living Facilities are also eligible for membership.

- Potential members also need to meet the underwriting standards or PELICAN to be eligible to become insured. There is no assurance that a particular entity will be eligible to become an insured, or that an insured will remain eligible to be insured pursuant to the RRG’s underwriting standards.

Other Program Information

Claims Philosophy

The PELICAN philosophy on liability claims can be summed up very simply:

- If we owe it, we will settle it for a reasonable amount.

- If we don't owe it, we will resist the claim vigorously.

The County Commissioners of Pennsylvania Insurance Program employs claims professionals who are experts in PA tort law, Municipal Tort immunity and civil rights law and who handle claims aggressively and manage the litigated files. Furthermore, the claims department works closely with Corporate Counsel and a selected group of outstanding defense attorneys who provide the PELICAN program with dependable legal opinions and vigorous representation.

PELICAN recognizes that members have to take a stand on principles and that nuisance settlements often encourage additional litigation. As a result, PELICAN continues to defend cases that many insurance carriers would settle for economic reasons for a few hundred or a few thousand dollars. PELICAN is willing to take cases to trial, but we do this with our eyes open, recognizing the potential exposure. As a rule, PELICAN only takes cases to trial if the claims are defensible or if an important principle is involved. Historically, our track record at trial is very strong.

There are, however, situations in which our ability to defend the case is weakened because of unclear legal issues, poor witnesses, inadequate documentation, inflammatory facts and other similar problems. In such cases, we will attempt to settle the claim for a reasonable amount.

Additionally, we attempt to identify cases with a large potential exposure early on, and investigate those cases thoroughly along with defense counsel, so that the decision to defend or settle can be made before we incur substantial attorney fees.

Risk Control Services

Because many exposures of a member may be difficult to detect, it is important for risk managers to obtain expert advice for controlling losses and minimizing costs. PELICAN's risk management services offer members the expertise of a qualified loss control specialist. The specialist may identify potential hazards or loss causing conditions and make recommendations to help the member control these exposures.

PELICAN's risk management services are provided FREE to all subscribers and are just a part of a full range of programs and services designed to meet the needs of our subscribers.

PELICAN's risk management services may be the members' most critical element in bottom line cost control.

Available loss control services include the following:

- Conducting facility safety audits and walkthroughs.

- Providing educational opportunities. As many as 36 loss control workshops are held annually around the state.

- An educational workshop at the PACAH conferences both in the spring and the fall.

- Webinars offered to subscribers twice a year.

- Online safety training programs available for all subscribers staff to enroll.

- A free safety video lending library for subscribers’ use.

- Monthly medical device recall notifications sent by email to subscribers.

PELICAN encourages their subscribers to participate in risk control activities in order to lessen the chances of a loss and also to reduce the cost of losses when they do occur. The PELICAN Risk Control Prevention Credit Program rewards subscribers who participate in risk control activities with a reduction of their premium costs, up to 5 percent annually.